Guide to Giving: What to Give

Aug 27, 2018

This is the second article in a Guide to Giving blog series by contributing editor Richard B. Freeman. Richard is a Senior Director, Wealth Advisor at Round Table Wealth Management and a member of FCCF’s Professional Advisors Council.

You are at a point in your life where you feel financially secure (or on your way there!) and feel you can afford to make charitable gifts. Of course, you can always write a check—but are there smarter ways to give using some of your noncash assets? You might be surprised at the wide range of assets a charity may accept. This is important to consider, as certain noncash gifting strategies that involve appreciated assets can reduce your tax bill and maximize the impact of your gift.

Several key questions come into play as you start to consider gifting a noncash asset. What is the value of the asset being gifted?[1] What is the income tax treatment of the gift?[2] (For many appreciated assets it makes sense to donate the asset rather than selling – and paying capital gains tax – to raise cash for the gift.) Are there any restrictions on transferring the asset to a charity? Will the charity accept the asset? How soon after the gift will the charity have access to use the funds?

After establishing some ground rules for gifting, a number of noncash gift strategies and their tax treatments are explored below.

Three Ground Rules for Gifting Noncash Assets

- It is always a good idea to get a receipt for your gift if the value exceeds $250.

- The IRS asks for an independent appraisal for gifts of $5,000 or more, unless the gift is cash or publicly listed investment securities.

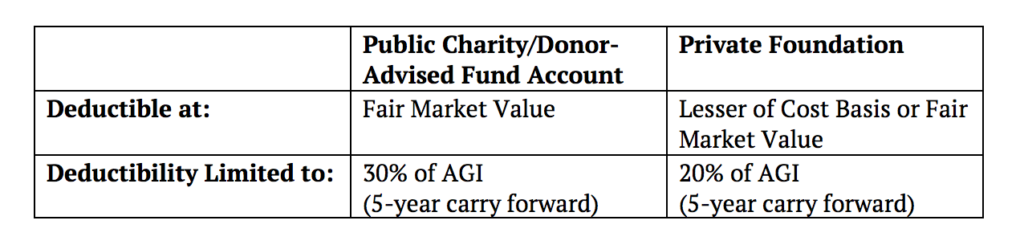

- Know that your annual charitable gift tax deduction is generally limited to 60% of your Adjusted Gross Income (AGI), and that unused deductions may be carried forward for five years. Your deduction may be further limited to 30% or 20% of AGI, depending on the type of property you give and the type of organization you give to.

Strategies for Gifting Noncash Assets

a. Publicly Traded Securities

Perhaps the most common—and easiest—strategy using noncash assets is to gift appreciated stocks, mutual funds, exchange traded funds and other publicly traded securities. Importantly, for securities held more than one year, the tax deduction is valued at the fair market value on the date of the gift. This results in the unrealized long-term capital gain escaping taxation – which means more of your donation goes to the charity and less goes to Uncle Sam!

Conversely, if a publicly traded security had decreased in value below the cost basis, you would be better off selling it and donating the cash proceeds. You could then use the realized capital loss to offset any realized capital gains elsewhere in your portfolio. If you do not have any realized gains, your realized capital losses may be carried forward to use to offset realized gains in future years.

IPO stock held for more than one year after the initial investment will qualify for long term capital gain treatment. Note that if donated during a lock-up period, certain valuation discounts may apply and an appraisal may be needed.

Donated publicly traded partnerships—notably master limited partnerships (MLPs)—are limited in their charitable deduction. The deduction must be reduced by the amount of ordinary income that would have been realized had the investment been sold.

b. Non-Publicly Traded Investments

The rules for gifting non-publicly traded investments can be more complex than those for publicly traded securities. Below we will look at general deductibility rules, then discuss asset tax treatments and descriptions of various non-publicly traded assets to consider gifting to charity.

The deductibility limits for donations of non-publicly traded investments to public charities or private foundations are generally as follows:

It is also worth noting that a charity is more likely to accept non-publicly traded investment assets if a sale is anticipated in the near future. Care must be taken, however, in that if a sale negotiation is almost complete before the donation is made, the IRS may consider it a prearranged sale, in which case the donor may be liable for any gain upon the sale of the asset.

Restricted Stock

Executives at public companies may own restricted stock and wish to donate it to charity. Permission from the company’s general counsel might be needed for the donation. A discount on the valuation may apply based upon the specific restrictions. An appraisal may also be needed.

Privately Held Stock (C-Corp and S-Corp)

Governing documents must be reviewed to understand transfer restrictions when gifting privately held stock. An appraisal must be obtained and will likely include valuation discounts due to lack of marketability and/or minority interests involved in this type of transaction. Also keep in mind that gifts of indebted interests may trigger adverse tax consequences. For S-Corp stock, the charity may be subject to unrelated business income tax (UBIT) on the gain from sale of its shares.

Limited Partnerships or Limited Liability Companies

Most rules for donating limited partnerships and limited liability companies are very similar to those for privately held stock discussed above. Additionally, keep in mind that, unless the donated interest can be sold back to the entity, a sale could be difficult to arrange.

Private Equity, Venture Funds, and Hedge Funds

Most hedge fund interests can be redeemed periodically at net asset value. For private equity and venture funds, some charities will be willing to wait until the planned liquidation period. However, the receiving charity generally will not be willing to assume any liabilities associated with these investments.

c. Other Property Types

Personal Property

You can donate almost anything, including household goods, old clothing, cars and more. Your tax deduction is limited to the lesser of your purchase cost or the current value of the property you are donating.

Collectibles and Artwork

Donations of collectibles and artwork must be for “related use” (meaning that the asset(s) donated are related to the charitable mission) in order to obtain a deduction of the fair market value. A painting donated to an art museum is a good example. If the painting is donated for “non-related use,” then the deduction would be the lesser of the donor’s cost basis or the fair market value. This would apply if, for example, the painting is donated to a religious organization. In most cases, gifting a non-related use asset will result in a lower tax deduction.

Life Insurance

You can make a charity the beneficiary of a life insurance policy. At death the charity will collect the death benefit free of any taxes. During your life, you would still be responsible for maintaining the policy.

Alternatively, you can gift the policy to a charity during your lifetime. This would allow you to claim a charitable income tax deduction for the lesser of the “adjusted cost basis” or the fair market value of the policy. The adjusted cost basis is the total of premiums paid less any withdrawals. In order to make sure the policy stays in-force until your death, you would make charitable contributions each year in the amount of the premium due.

Ordinary Income Property

This covers property that had you sold it, would be taxed at ordinary income tax rates.

Examples include inventory, short term capital gain assets (held for one year or less), and some assets used in a trade or business. The tax deduction is the lesser of fair market value or cost basis.

Real Estate

For primary or secondary homes, the property should be marketable and generally debt free. The charity will control the sale after the donation.

Commercial real estate donations are more complex and involve additional legal and tax considerations.

Charitable gifts of noncash assets can be a complex but rewarding path to achieve your charitable goals. Keep in mind that not all charities are prepared to accept these types of gifts, so check with them before you begin. With the right professional help, you should be able to fulfill your gift intentions and maximize the impact of your charitable gifts.

Whatever your charitable goals are, Fairfield County’s Community Foundation (FCCF) can help you determine the best way to reach them. Please contact Joe Collin, Vice President of Philanthropy at (203) 750-3200 or jcollin@fccfoundation.org for a personal conversation about your charitable goals.

[1] This article discusses completed gifts only; gifts of a partial (shared) interest are not addressed.

[2] Consult your tax advisor for the best options for your personal circumstances. Your tax advisor can help you with both the confirmation of the proper tax treatment of a contemplated strategy as well as whether you should use a charitable income tax deduction or a standard deduction; the Tax Cut and Jobs Act of 2017 has impacted this decision for many taxpayers.

More on Richard B. Freeman

Richard B. Freeman is a Senior Director, Wealth Advisor at Round Table Wealth Management. He is a member of FCCF’s Professional Advisor Council.

Richard B. Freeman is a Senior Director, Wealth Advisor at Round Table Wealth Management. He is a member of FCCF’s Professional Advisor Council.

Rich can be reached at (203) 658-6740 or rich@roundtablewealth.com.

Website: https://www.roundtablewealth.com/

LinkedIn: https://www.linkedin.com/in/richardbfreeman